Get the free renters rebate

Show details

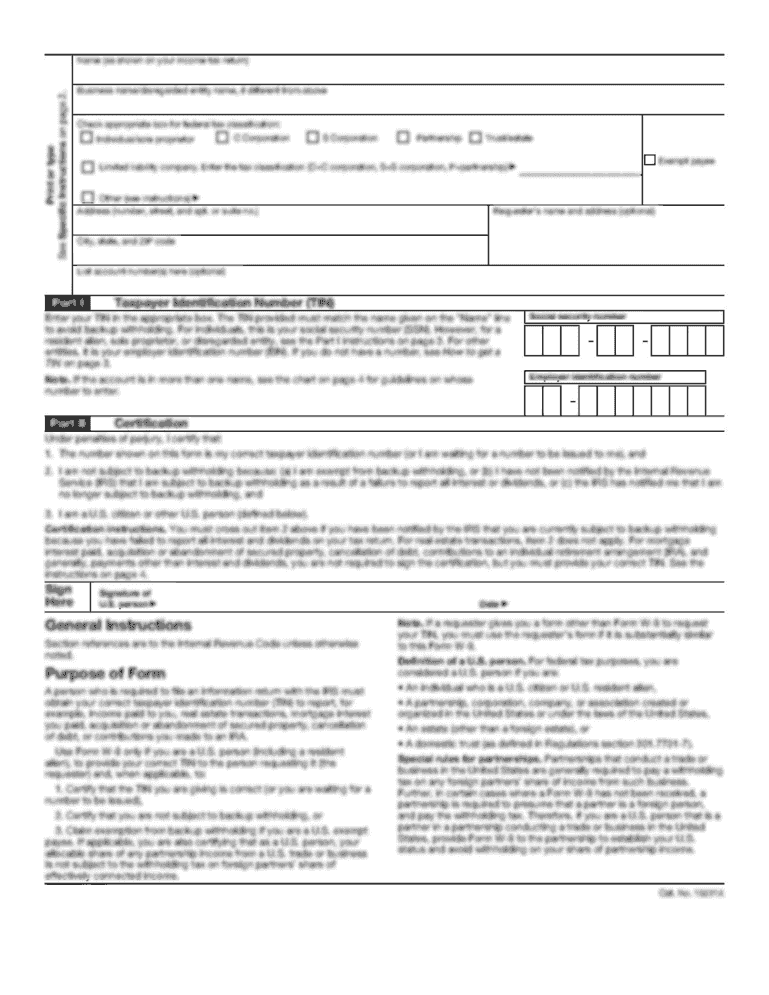

Clear form Utah State Tax Commission Renter Refund Application (Circuit Breaker Application) 2011 TC-40CB Rev. 3/11 Send this application to Taxpayer Services Division Utah State Tax Commission, 210

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rent rebate form

Edit your renter's rebate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rent rebate forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit how to apply for rent rebate online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit renters rebate form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out renters rebate form

How to fill out renters rebate utah:

01

Gather necessary documents such as proof of rent paid, landlord information, and household income documentation.

02

Access the official website of Utah State Tax Commission or visit a local tax office to obtain the renters rebate application form.

03

Fill out the form accurately, providing personal information, rental details, and income information as required.

04

Attach all the supporting documents to the completed form.

05

Double-check all the information and make sure everything is filled out correctly.

06

Submit the application by mailing it to the designated address or by submitting it electronically, if available.

Who needs renters rebate utah?

01

Renters who reside in Utah and meet the eligibility criteria may apply for the renters rebate program.

02

Individuals or households who pay rent to a landlord for their primary residence in Utah are eligible.

03

Applicants must have a verifiable renter's income that falls within the specified income limits set by the program in order to qualify for the renters rebate.

Fill

form

: Try Risk Free

People Also Ask about

How much is the mn tax rebate 2023?

Minnesota Revenue Commissioner Paul Marquart speaks at a news conference at the Minnesota State Capitol in St. Paul on Wednesday, Aug. 16, 2023. Income tax rebates of $260 for individuals and up to $1,300 for families of five are already starting to show up in the bank accounts of about 2.1 million Minnesota residents.

How much do you get back for renters rebate in MN?

For refund claims filed in 2022, based on rent paid in 2021 and 2021 household income, the maximum refund is $2,280. Renters whose income exceeds $64,920 are not eligible for refunds. How are claims filed? Refund claims are filed using Minnesota Department of Revenue (DOR) Schedule M1PR.

How much is the Minnesota tax rebate?

The rebate checks, approved by state lawmakers this spring, are for $260 with an additional $260 for each eligible dependent, up to three. That means the biggest rebate checks max out at $1,300.

How do you qualify for a circuit breaker?

Income eligibility for circuit breakers varies widely across states. In 2022, income limits on state circuit breakers ranged from $5,501 in Arizona to $134,800 in Vermont. Some states further restrict eligibility based not just on income, but on families' overall wealth holdings or the assessed value of the home.

Does Utah have a renters credit?

Utah provides financial relief to qualified renters for the property taxes they pay indirectly to the landlord through their monthly rent. The renter refund applies to both renters and to manufactured homeowners who rent their lots.

What is renters credit on taxes?

To be eligible, an individual must be a resident of California and must have paid rent for at least half of the tax year. The credit is $60 for single individuals and $120 for head of households or married couples.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify renters rebate form without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your renters rebate form into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit renters rebate form on an iOS device?

Create, modify, and share renters rebate form using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I complete renters rebate form on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your renters rebate form, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is renters rebate form?

The renters rebate form is a document that allows eligible individuals to claim a refund for a portion of rent paid during a specific tax year. It is typically used in various states to provide financial relief to low-income renters.

Who is required to file renters rebate form?

Individuals who meet certain income and residency requirements and who have paid rent for their primary residence may be required to file a renters rebate form to receive potential financial assistance.

How to fill out renters rebate form?

To fill out a renters rebate form, individuals need to provide personal information such as name, address, income details, and the amount of rent paid. It is important to follow the specific instructions provided with the form and ensure all required documentation is included.

What is the purpose of renters rebate form?

The purpose of the renters rebate form is to assist eligible renters in recovering some of the rental costs they have incurred, thereby alleviating housing costs for low-income individuals and families.

What information must be reported on renters rebate form?

The information that must be reported on the renters rebate form typically includes personal identification details, rental property information, total rent paid, income information, and any other relevant financial details as specified by the state or locality.

Fill out your renters rebate form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Renters Rebate Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.